Home equity loan calculator usaa

But also because youre not carrying a. In exchange for an available cost reduction or waiver if you pay off and close the loan within a certain period usually three years you may.

How Long Does It Take To Get Pre Approved For A Mortgage Credible

You can negotiate draw periods repayment periods periods of fixed interest and many other aspects of your loan.

. The average 30-year fixed mortgage rate rose from around 3 in December 2021 to 589 currently according to Freddie Mac. MC 20979 Control No. Pricing may vary by state.

11 2020 and subject to the assumptions described immediately above. A home equity line of credit HELOC to decide which option is best for your financial goals. Learn the ins and outs of a home equity loan vs.

Estimate your monthly loan repayments on a 250000 mortgage at 4 fixed interest with our amortization schedule over 15 and 30 years. Licensed in 50 states. Chase does not offer traditional home equity loans which makes them somewhat difficult to compare to other lenders.

The banks CD rates tend to be significantly lower than those at the. ARM interest rates and payments are subject to increase after the initial fixed-rate period 5 years for. Amortization means that at the beginning of your loan a big percentage of your payment is applied to interest.

Loan Requirements Because Wells Fargo does not offer home equity loans it is hard to assess them in terms of requirements compared to other lenders. 12 The companies with the lowest. Why LightStream is the best personal loan for generous repayment terms.

Home equity loans home equity lines of credit allow homeowners to borrow against a portion of their home equity while maintaining their first mortgage at its existing low rate. 2000 Phoenix AZ 85004 Mortgage Banker License BK-0902939. Its loan terms range from two to seven years for most loans and 2-12 years for loans for home improvement swimming pools.

These are fixed-rate loans with terms of up to 20 years although you can get a lower. Estimated monthly payments shown include principal interest and if applicable any required mortgage insurance. Basic entitlement and bonus entitlement together are enough for a VA loan of 417000 or more.

First youll generally manage to snag a lower interest rate on a 15-year mortgage than on a 30-year loan so that alone can translate into big savings. They stopped offering home equity loans in August of 2015 so the line of credit is your only option if you are set on working with Wells Fargo for your home equity product needs. However their lines of credit are some of the most flexible in the industry.

NMLS consumer access pageEqual Housing Lender. With each subsequent payment you pay more toward your balance. When added to basic entitlement bonus entitlement gives eligible veterans enough VA backing for a.

The first is a standard home equity loan where you borrow a single lump sum secured by the equity in your home. TransUnion published a study in 2017 which suggested there will be an average of 2 million HELOCs per year between 2018 and 2022. A home equity calculator can provide a glimpse of how much you can borrow.

In most cases youre limited to borrowing a total of 85 of your home. Licensed by the Department of Financial. Jeff Gitlen is a graduate of the Alfred Lerner College of Business and Economics at the University of Delaware.

Additional restrictions apply to Texas home equity loans. Note 4 If all occupying borrowers have not owned a home in the past three years and plan to apply for a USAA Federal Savings Bank 30-Year Conventional Loan with less than a 5 down payment at least one borrower on the mortgage loan will need to complete a free homebuyer education course online before closing. The following examples describe the terms of a typical loan for rates available on Aug.

Beware of the catch though. The advertised rates are based on certain assumptions and loan scenarios. To find the best mortgage rates we analyzed all 30-year loans from the biggest lenders in 2021 the most recent data available.

Home equity loan closing costs and fees. USAA allows you to borrow against up to 80 percent of your home value on a home equity loan minus whatever you still owe on your current mortgage. Please enter a minimum of three characters.

Other rates and terms available. How a Home Equity Loan Works Rates Requirements Calculator A home equity loan is a consumer loan allowing homeowners to borrow against the equity in their home. 1050 Woodward Ave Detroit MI 48226-1906 888 474-0404.

Mortgage rates valid as of 12 Sep 2022 0248 pm. Central Daylight Time and assume borrower has excellent credit including a credit score of 740 or higher. He has spent the last 5 years researching and writing about personal finance topics including student loans credit cards insurance and more.

Although some lenders may reduce or waive them altogether home equity loan closing costs typically range anywhere from 2 to 5 of the loan amount. Who has the best mortgage rates. USAA Federal Savings Bank offers 13 terms for standard certificates of deposit CDs ranging from 91 days to seven years.

What Are Current Mortgage Rates.

What Can You Buy With A Va Loan

Basic Training About Va Loans Va Loan Loan Debt To Income Ratio

/veteransunited-b0729646b8704c3d802b67aab5567c65.jpg)

Best Va Loan Rates Of 2022

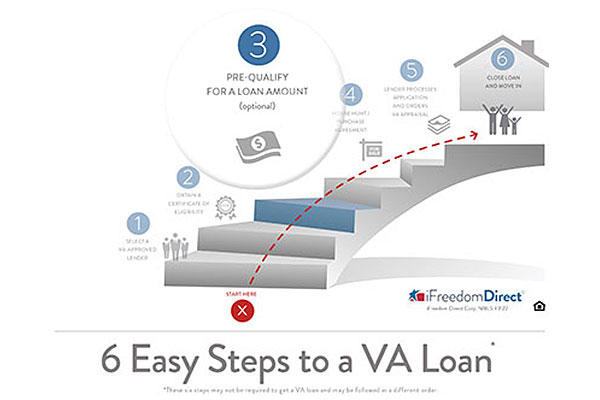

Step By Step To A Va Loan 3 Prequalifying Military Com

Va Loan Funding Fee Closing Cost Calculator

10 Va Loan Myths Busted Home Loans Va Loan Loan

Can I Lower My Mortgage Rate Without Refinancing Lendingtree

Va Loan Funding Fee Closing Cost Calculator

Am I Eligible For A Va Home Loan Va Home Loan Eligibility

Usaa Home Equity Loan And Heloc Alternatives Lendedu

Tumblr Home Loans Usda Loan Usda

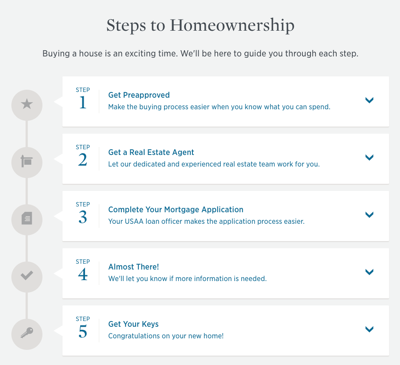

Usaa Mortgage Review 2022 Smartasset Com

Va Loan For A Second Home How It Works Lendingtree

Va Mortgage Calculator Calculate Va Loan Payments

Usaa Mortgage Review 2022 Smartasset Com

Am I Eligible For A Va Home Loan Va Home Loan Eligibility

How To Read A Monthly Mortgage Statement Lendingtree