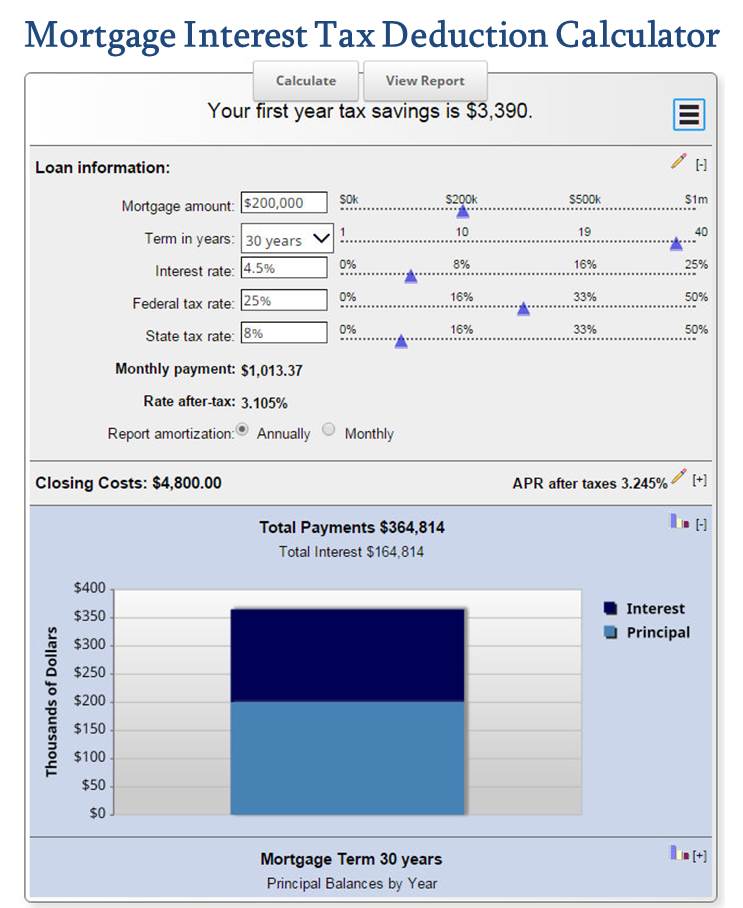

Mortgage interest tax deduction 2020 calculator

The changed rules are tighter than they were in 2017. But the 2018 tax law no longer allows the deduction of interest paid.

What Is The Salt Tax Deduction Forbes Advisor

Taxpayers who live in states that dont have an income tax are probably better off using their sales tax for the deduction.

/ScreenShot2021-02-12at3.32.18PM-40b79df9059346d4aaef488825e16a46.png)

. Which had them paying both halves of the tax. You may only deduct interest on acquisition indebtednessyour mortgage used to buy build or improve your. Use this federal income tax calculator to estimate your federal tax bill and look further at the changes in 2021 to the federal.

Yes No State and Local Taxes SALT Sales Taxes. You cant deduct anything that pays off the original loan amount but any amount you pay to pay off. For 2020 the FICA limit is on the first 137700 of income.

Yes your deduction is generally limited if all mortgages used to buy construct or improve your first home and second home if applicable total more than 1 million 500000 if you use married filing separately status for tax years prior to 2018. Since 2017 if you take the standard deduction you cannot deduct mortgage interest. If youre not completely satisfied with our Excel Tax Calculator well send you a full refund.

For the 2020 tax year the standard deduction is 24800 for married couples filing jointly and 12400 for. This law greatly affected the tax deduction for interest on a mortgage refinance loan. Taxes are unavoidable and without planning the annual tax liability can be very uncertain.

You can deduct home mortgage interest on the first 750000 375000 if married filing separately of indebt-edness. Mortgage Tax Benefits Calculator. The 2020 standard deduction allows taxpayers to reduce their taxable income by 4601.

For tax year 2021 for example the standard deduction for those filing as married filing jointly is 25100 up 300 from the prior year. Is there a limit to the amount I can deduct. Acquisition debt comes from using a reverse mortgage to buy a house or refinancing debt that was acquisition debt.

Check out our mortgage calculator. Add your total state and local taxes capped at 10000 to the mortgage interest number you calculated above. Tax Changes for 2013 - 2022.

You cant deduct any of the taxes paid in 2021 because they relate to the 2020 property tax year and you. Mortgage interest paid on home loans of as much as 1 million is deductible. The mortgage is a secured debt on a.

However higher limitations 1 million 500000 if married filing separately apply if you are deducting mortgage interest from in-debtedness incurred before December 16 2017. New Law Allows Credit Freeze October 22 2018. The Supplemental Homestead Deduction is also for owner-occupied primary residences.

Use the following calculator to help determine your estimated tax liability along with your average and marginal tax rates. How the New FICO Credit Scoring System Will Affect You January 29 2020. For married taxpayers who file jointly its 25100 increased from 24800 in 2020.

On his Presidential campaign Senator Joe Biden proposed also imposing the payroll tax on every dollar of income above 400000. Home Mortgage Interest Form 1098. Use our income tax calculator to find out what your take home pay will be in California for the tax year.

Yes No Charity Contributions. 2 The limit on home equity interest deduction is not 100000 of interest but rather the interest on 100000 of home equity debt. At Simpleplanning we guarantee it.

For some investors thats a financial plus and makes an interest-only loan desirable. Income Tax Calculator. You filed an IRS form 1040 and itemized your deductions.

But that deduction applies to income earned in 2021. Most BTL deductions are the run-of-the-mill variety above including several others like investment interest or tax preparation fees. Changes in tax law went into effect on January 1 2018 with the Tax Cuts and Jobs Act TCJA.

To qualify for a home mortgage interest tax deduction homeowners must meet these two requirements. If the total is larger than your standard deduction youll likely benefit from itemizing. Based on the Information you entered on this 2021 Tax Calculator you may need the following 2021 Tax Year IRS Tax Forms to complete your 2021 IRS Income Tax Return.

High incomes will pay an extra 38 Net Investment Income Tax as part of the new healthcare law and be subject to limited deductions and phased-out exemptions not shown here in addition to paying a new 396 tax rate and 20 capital gains rate. Interest on Your Mortgage. Average 2020 property tax rates in Tippecanoe.

For the tax year 2021 the deduction for single filers is set at 12550 increased from 12400 for the 2020 tax year. The limits on deductions for acquisition debt are far higher than for home equity debt. If youre one of those landlords who possess a mortgage one of the largest homeowner deductions you can take is the interest payments on your mortgage.

September 24 2020. In 2021 and 2022 this deduction cannot exceed 10000. - 2020 Quick Tax Estimator - 2020 Detailed Tax Calculator - Tax Withholding.

Reducing your home mortgage interest deduction. Practically every homeowner will need to take out a mortgage to finance their property purchase. If you itemize your deductions on Schedule A Form 1040 you must reduce your home mortgage interest deduction by the amount of the mortgage interest credit shown on Form 8396 line 3.

Therefore make sure you know how it will affect you before you think about refinancing your mortgage. A lot of tax planning say their tax planners are simple to use. Using our 12000 mortgage interest example a married couple in the 24 tax bracket would get a 25100 standard deduction in 2021 which is worth 6024 in reduced tax payments.

Add up all of these taxes but remember the IRS limits your state and local tax deduction to 10000. Click here to download our Tax Calculator demo spreadsheet. This is equal to 35 of assessed value after the Homestead Standard Deduction has been applied up to 600000 and 25 of assessed value over 600000.

Its 18800 for those who qualify as.

Understanding The Mortgage Interest Deduction The Official Blog Of Taxslayer

Home Ownership Tax Benefits Mortgage Interest Tax Deduction Calculator

Can I Get A Student Loan Tax Deduction The Turbotax Blog

/ScreenShot2021-02-12at3.32.18PM-40b79df9059346d4aaef488825e16a46.png)

Schedule A Form 1040 Or 1040 Sr Itemized Deductions Definition

10 Creative But Legal Tax Deductions Howstuffworks

Mortgage Interest Tax Deduction Guide Nextadvisor With Time

California Solution For Federal State And Local Tax Salt Deduction Limitation Hayashi Wayland

Mortgage Interest Tax Deduction What Is It How Is It Used

What Can You Deduct At Tax Time 2020 Update Smartasset

Tax Deductions For Home Mortgage Interest Under Tcja

Tax Deductions For Home Mortgage Interest Under Tcja

Mortgage Interest Tax Deduction Calculator Mls Mortgage

Mortgage Tax Deduction Calculator Homesite Mortgage

Your 2020 Guide To Tax Deductions The Motley Fool

Infographic On Tax Deduction Changes For 2018 Dedicated Db

Mortgage Tax Deduction Calculator Freeandclear

Home Office Tax Deductions Mileage Tracking Log 2020 Tax Deductions Deduction Mileage