43+ debt to income ratio for mortgage approval

Web A debt-to-income ratio is a factor looked at by lenders when qualifying a borrower for a mortgage loan. So with 6000 in gross monthly income your maximum amount.

Debt To Income Ratio And Mortgage Approvals Bmo

Web Experts say you want to aim for a DTI of about 43 or less.

. Web How to calculate your debt-to-income ratio. Find a lender who can offer competitive mortgage rates and help you. Choose Smart Apply Easily.

Heres how lenders typically view DTI. Total monthly debt paymentsGross monthly income x 100 Debt-to-income ratio. Apply Online Get Pre-Approved Today.

With a Low Down Payment Option You Could Buy Your Own Home. In this formula total. Compare Now Find The Lowest Rate.

Why Rent When You Could Own. Web Qualifying Ratios. Get Instantly Matched With Your Ideal Mortgage Lender.

If you have a salary of 72000 per year then your usable income for. Use Our Comparison Site Find Out How to Get Mortgage Pre Approval In Minutes. Ad Tired of Renting.

Web According to a breakdown from The Mortgage Reports a good debt-to-income ratio is 43 or less. You can be eligible for a Verified Approval guarantee. With a Low Down Payment Option You Could Buy Your Own Home.

Trusted VA Home Loan Lender of 300000 Military Homebuyers. Lock Your Rate Today. Web Heres how the debt-to-income ratio is calculated.

Web While requirements for approval will vary between loan types a general guideline is to have a debt-to-income ratio of below 36 for a greater likelihood of loan. Get Your Quote Today. Web Whats the Max Debt-to-Income DTI Ratio for a Mortgage.

To calculate your DTI enter the payments you owe such as rent or mortgage student loan and auto loan payments. Many lenders may even want to see a DTI thats closer to. Web Based on your monthly income of 6000 your back-end ratio would be about 44 percent.

Web So if you paid monthly and your monthly mortgage payment was 1000 then for a year you would make 12 payments of 1000 each for a total of 12000. Ad First Time Home Buyers. The borrowers front-end ratio which is the total housing.

With a Low Down Payment Option You Could Buy Your Own Home. Web As a rule of thumb you want to aim for a debt-to-income ratio of around 36 or less but no higher than 43. Ad Compare Find the 10 Best Pre Approval Mortgage In US.

But with a bi-weekly. Ad Tired of Renting. Web Debt-to-income DTI ratio.

Ad Compare the Top Mortgage Lenders Find What Suits You the Best. Why Rent When You Could Own. Lock Your Rate Today.

VA Loan Expertise and Personal Service. Most loans require a DTI below 43. If your mortgage doesnt close after getting pre.

Special Offers Just a Click Away. Web A debt-to-income ratio over 43 may prevent you from getting a Qualified Mortgage. Possibly limiting you to approval for home loans that are more restrictive or expensive.

Ad Get Instantly Matched With Your Ideal Mortgage Lender. Ad Compare Find the 10 Best Pre Approval Mortgage In US. It Only Takes 3 Minutes To Get a Rate 25 Days To Close a Loan.

Results of the mortgage affordability estimateprequalification. Apply Easily Save. Apply Easily Save.

Check Your Eligibility for a Low Down Payment FHA Loan. Getty Images A good debt-to-income ratio is key to loan approval whether youre seeking a mortgage. Web Usable income depends on how you get paid and whether you are salaried or self-employed.

With a Low Down Payment Option You Could Buy Your Own Home. Get Instantly Matched With Your Ideal Mortgage Lender. The debt-to-income DTI ratio is a personal finance measure that compares an individuals debt payment to his or her overall.

Web Debt-To-Income Ratio - DTI. Debt-to-income DTI ratio determines what mortgage youre eligible for. Take the First Step Towards Your Dream Home See If You Qualify.

Web If your gross monthly income is 6000 then your debt-to-income ratio is 33 percent 2000 is 33 of 6000. Ad Compare Best Mortgage Lenders 2023. So before getting pre-approved your.

Contact a Loan Specialist. A set of ratios that are used by lenders to approve borrowers for a mortgage.

Debt To Income Ratio Calculator For Mortgage Approval Dti Calculator

How To Calculate Your Debt To Income Ratio For A Mortgage

Debt To Income Ratio Dti What It Is And How To Calculate It

Debt To Income Ratio For Mortgages Explained

Interim Consolidated Financial Statements Of Bpce

Debt To Income Dti Ratio Requirements For A Mortgage

Everything You Need To Know About The Pre Approval Process

Debt To Income Ratio And Mortgage Approvals Bmo

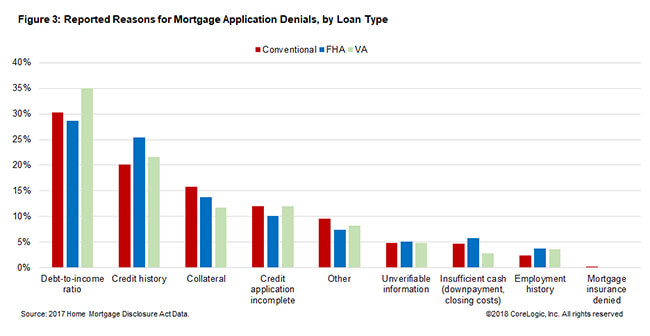

Debt To Income Is The Number One Reason For Denied Mortgage Applications Corelogic

Debt To Income Ratio Calculator For Mortgage Approval Dti Calculator

What S A Good Debt To Income Ratio For A Mortgage

Debt To Income Ratio And Mortgage Approvals Bmo

What S A Good Debt To Income Ratio For A Mortgage

![]()

Dti Calculator Home Mortgage Qualification Debt To Income Ratio Calculator

Ideal Debt To Income Dti Ratio To Qualify For A Mortgage Finder Com

How To Calculate Your Debt To Income Ratio For A Mortgage

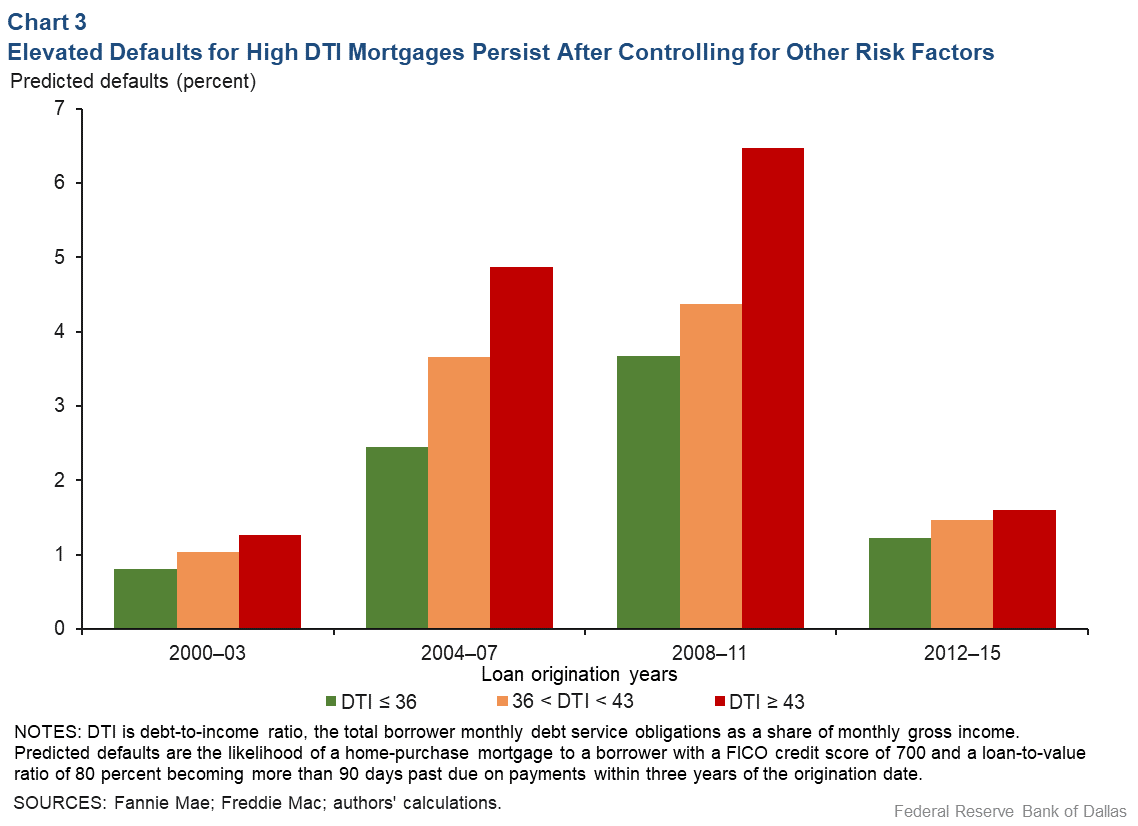

Ability To Repay A Mortgage Assessing The Relationship Between Default Debt To Income Dallasfed Org